![]() We all know the feeling when the car insurance is up for renewal, and despite the most careful driving it can feel like prices are only ever on the up. Read on for some cunning tips which could slash a tidy amount from your car insurance bill.

We all know the feeling when the car insurance is up for renewal, and despite the most careful driving it can feel like prices are only ever on the up. Read on for some cunning tips which could slash a tidy amount from your car insurance bill.

1. Shop around

1. Shop around

It's easy to assume that staying with the same insurer will be the cheapest option. Unfortunately it's not always this simple, and there may be rival insurers who are able to beat your renewal quote.

It takes more time than simply hitting the renewal button, but you might be surprised how much you could save by shopping around.

Price comparison websites can do a lot of the work for you but is is important to ensure that you are comparing like-for-like. It's also worth bearing in mind that not all insurance companies will be listed on price comparison sites, so doing your research is important.

2. Change your career

2. Change your career

OK, that might be a little drastic. However, your profession does have an impact on how much you will be quoted for car insurance, and experimenting with different job descriptions is always worth a try.

Obviously you must be truthful, but there are significant price differences between two very similar job titles. For example, an illustrator is often cheaper than an artist, an editor is cheaper than a journalist, and a PA will cost you less than a secretary.

3. Declutter

3. Declutter

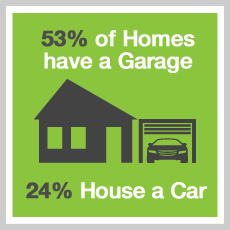

Many of us own garages, but few people actually use them for their intended purpose of storing a car. Statistics reveal that around 53% of homes in Britain have a garage, but only 24% of these actually house a car.

One of the reasons for this may be that many garages were built in the 1950s and can no longer accommodate the larger cars of today. However, if you're blessed with a large garage it's worth decluttering and actually making room for your vehicle. Keeping your car in a garage means it is less susceptible to accidental damage, and can thus lead to lower insurance premiums.

4. Switch midyear

4. Switch midyear

Again, this will require some homework, but could potentially save you bundles. You don't need to wait for your renewal letter to think about switching, and you can usually cancel your existing policy with a refund for the rest of the year, providing you haven't claimed.

Sometimes there may be a cancellation fee but this is often eclipsed by the overall saving. Switching midyear can be especially canny if upcoming changes in legislation can mean a rise in insurance premiums overall.

5. Install a car tracker

5. Install a car tracker

These use global positioning technology to track the whereabouts of your vehicle.

If your car is stolen, simply activate the tracker and your vehicle can be located, and hopefully the thieves can be caught red-handed. Increasingly, insurers are offering tasty discounts for owners who install tracking devices like the ones stocked here at Tracker Fit. So in the long run it pays to kit your vehicle out with a high quality tracking device and you won't worry as much!

Keep these sneaky tips and tricks in mind next time your insurance is due, and see how much money you could save! For more information on our range of car trackers then feel free to call our expert team on 0800 756 5100.